Find and Hire Local US Tax Services

Consultants 500 connects clients with US tax service providers . Via our platform, you can easily create a shortlist of service providers located in the US who provide US tax services that meet your demands, compare them, and hire the best one for the job and that only within a few minutes.

Searching with

United States ☓

Your search results

Entigrity Solutions

Your Offshore Staffing Partner

- Lower Market ($)

- Accounting, Audit & Advisory, Tax Firms

Entigrity helps accountants, CPAs, Tax Professionals, EAs to hire offshore staff and save 75% on labor costs. Our flexible and transparent hiring model lets you hire Accountant, Bo…

View moreEntigrity helps accountants, CPAs, Tax Professionals, EAs to hire offshore staff and save 75% on labor costs. Our flexible and transparent hiring model lets you hire Accountant, Bookkeeper, Tax Preparer, etc starting at $9/hour flat and no compliance, payroll tax or benefits. With Entigrity you can hire staff for short term, long term, full time, part time or seasonal work needs. We are based in Sugar Land, Texas and are recognized by multiple National and State CPA socities.

- Accounting

- CPA

- TAXATION

Sanwar H.

CPA, CIA,CISA,CFF,FCA,CRMA,CGMA,CCA

- $100-200/hr

- Accounting, Audit & Advisory

- Consulting

- Tax Firms

1. Auditing & Assurance Services like single audit, financial audit, internal audit, employees benefit plan audit, performance audit, corporate reporting, regulatory compliance, revenue recognition, company’s audit etc. 2. Account…

View more

1. Auditing & Assurance Services like single audit, financial audit, internal audit, employees benefit plan audit, performance audit, corporate reporting, regulatory compliance, revenue recognition, company’s audit etc.

2. Accounting & Bookkeeping services like Accounting Software Implementation, Accounts Payable & Accounts Receivable Management, Business Accounting, Cloud Accounting, Professional Outsourcing, General Ledger Reconstruction, Payroll Services etc.

3. Consulting & Management Advisory Services including Financial Advisory Services, Transaction Advisory services, Risk Advisory services, Management Advisory services, Technology Advisory services, Litigation, Arbitration & Dispute Advisory services etc.

4. Taxation Services including Business Tax calculation and regulatory form submission, International Tax, Personal Tax, State & Local Tax, Indirect Taxes, Tax Accounting, Tax planning, Tax Transaction Advisory Services, Tax Reporting & Strategies, Tax controversy & dispute resolution and Tax policy & administration.

5. Technology Services including but not limited to providing technology solutions to business problems, recommending accounting and business software, overseeing installation and training of business software and many more

- Auditing

- accounting

- consulting

- management advisory and technological se…

- NPO’s

- state & local governments

- health institutions and clinics

- housing authorities

Patel & Associates LLP

CPA

- Middle Market ($$)

- Accounting, Audit & Advisory, Tax Firms

Patel & Associates LLP is a leading provider of accounting, audit and IT consulting services. We guide our clients through complex business challenges by understanding their needs…

View morePatel & Associates LLP is a leading provider of accounting, audit and IT consulting services. We guide our clients through complex business challenges by understanding their needs and bringing together the right team to address them and we can meet your needs wherever in the world you do business. Long term relationships are built on quality results. Patel & Associates LLP has served commercial, individual, and governmental clients with a tradition of quality audit, accounting, and advisory services. Our quality difference is rooted in our standards of professionalism.

- At PALLP

- we have developed our expertise in provi…

- accounting

- consulting

- management advisory and technological se…

- NPO’s

- state & local governments

- health institutions and clinics

Harshwal & Company LLP

CPA Firm

- Middle Market ($$)

- Accounting, Audit & Advisory, Consulting, Tax Firms

Harshwal & Company LLP is a leading provider of accounting, audit and IT consulting services, licensed in California and New Mexico, we are authorized to practice in 45 additional…

View moreHarshwal & Company LLP is a leading provider of accounting, audit and IT consulting services, licensed in California and New Mexico, we are authorized to practice in 45 additional states that have licensing reciprocity. We guide our clients through complex business challenges by understanding their needs and bringing together the right team to address them and we can meet your needs wherever in the world you do business.

- At Harshwal & Company

- LLP

- we have developed our expertise in provi…

- accounting

- consulting

- management advisory and technological se…

- NPO’s

- state & local governments

Miller & Company LLP: CPA of NYC

Accountant

- Accounting, Audit & Advisory, Tax Firms

Licensed in New York, the professionals at Miller & Company have served top-tier Manhattan clients since 1997. They exceed your every expectation with full-service dedication to yo…

View moreLicensed in New York, the professionals at Miller & Company have served top-tier Manhattan clients since 1997. They exceed your every expectation with full-service dedication to your financial needs. They spend time with you before delivering customize accounting strategies that improve your life and facilitate your lifestyle. Miller & Company serves New York’s elite with distinction, professionalism and responsiveness. Miller & Company leads the industry in customized, personal accounting services, delivering world class consulting, compliance and tax services. The accounting team focuses solely on your financial goals and desired outcomes. Totally invested in your success, they work with your business as if it were their own. Contact Miller & Company for tax services and QuickBooks accounting. Miller & Company caters to high net-worth individuals and thriving businesses that need a personal touch and an analytical eye. If that describes you, call Miller&Company LLP on (646)-865-1444 for innovative accounting and strategic services such as: Strategic business planning Business consulting Certified audits Tax audits Audited financial statements Corporate and personal tax preparation Tax representation Bookkeeping Working Hours: Monday – Friday: 9:00 am – 7:00 pm; Saturday: 9:00 am – 4:00 pm, Sunday: Closed Payment: cash, check, credit cards CONTACT US Miller & Company LLP: CPA of NYC Midtown Manhattan, NY 274 Madison Ave, Suite 402, New York, NY 10016 (646)-865-1444 Miller & Company LLP Queens, NYC 141-07 20th Ave, Suite 101, Whitestone, NY 11357 718-767-0737 Manhattan, NYC 18 East 48th Street, #1001 New York, NY 10017 (646) 367-3726 https://www.cpafirmnyc.com Our Locations on the Map: https://g.page/accountant-queens-cpa-firm-nyc?share https://g.page/accountant-nyc-cpa-firm-new-york https://goo.gl/maps/RspwfraQnwLQhfoW7 https://goo.gl/maps/5HyvFG6FphYZ5YJb7 Keywords: accountant nyc, cpa firms in nyc, manhattan cpa, cpa manhattan, best accountants nyc, manhattan cpa firm, manhattan accounting firms, best small business accountant, best cpa firm, best tax accountant, tax accountant manhattan, tax cpa manhattan, top nyc accounting firm, midtown manhattan cpa firm, accounting firms in manhattan, best cpa firms, , irs payment plan, tax preparation, retirement planning, tax lien, deferred tax asset, tax levy, tax audit, small business accountants, tax planning, federal tax lien, audited financial statements, payroll accounting, small business bookkeeping, cash flow management, tax resolution services, business consulting nyc, irs audit triggers, expatriate tax, international tax accountant, forensic accounting nyc, qualified domestic trust, business registration nyc, certified audit, tax representation, pension audits, financial statement review, international tax planning, international tax consultant, irs innocent spouse, accounting services nyc, strategic planning nyc, business accounting nyc, cpa self employed manhattan, high net worth retirement planning

Rasul Professional Services

- Middle Market ($$)

- Accounting, Audit & Advisory, Tax Firms, Web, Mobile, Software Design & Development

As you browse through our Website, you will see that not only have we highlighted background information on our firm and the services we provide, but have also included useful reso…

View moreAs you browse through our Website, you will see that not only have we highlighted background information on our firm and the services we provide, but have also included useful resources such as refund status, locate IRS, SSA, USCIS & Department of Labor offices and interactive calculators. In addition, we have taken the time to gather links to external Websites that we felt would be of interest to our clients and visitors (in our Resource section).

- Business setup

- Website Development

- Tax Preparation

- Bookkeeping

Miller & Company LLP

Accountant

- Accounting, Audit & Advisory, Tax Firms

Licensed in New York, the professionals at Miller & Company have served top-tier Manhattan clients since 1997. They exceed your every expectation with full-service dedication to yo…

View moreLicensed in New York, the professionals at Miller & Company have served top-tier Manhattan clients since 1997. They exceed your every expectation with full-service dedication to your financial needs. They spend time with you before delivering customize accounting strategies that improve your life and facilitate your lifestyle. Miller & Company serves New York’s elite with distinction, professionalism and responsiveness. Miller & Company leads the industry in customized, personal accounting services, delivering world class consulting, compliance and tax services. The accounting team focuses solely on your financial goals and desired outcomes. Totally invested in your success, they work with your business as if it were their own. Contact Miller & Company for tax services and QuickBooks accounting. Miller & Company caters to high net-worth individuals and thriving businesses that need a personal touch and an analytical eye. If that describes you, call Miller&Company LLP on 718-767-0737 for innovative accounting and strategic services such as: Strategic business planning Business consulting Certified audits Tax audits Audited financial statements Corporate and personal tax preparation Tax representation Bookkeeping Working Hours: Monday – Friday: 9:00 am – 7:00 pm; Saturday: 9:00 am – 4:00 pm, Sunday: Closed Payment: cash, check, credit cards CONTACT US Miller & Company LLP Queens, NYC 141-07 20th Ave, Suite 101, Whitestone, NY 11357 718-767-0737 Miller & Company LLP: CPA of NYC Midtown Manhattan, NY 274 Madison Ave, Suite 402, New York, NY 10016 (646)-865-1444 Manhattan, NYC 18 East 48th Street, #1001 New York, NY 10017 (646) 367-3726 Washington, DC 700 Pennsylvania Ave, SE, Ste 2050 Washington, DC 20003 (202) 547-9004 https://www.cpafirmnyc.com Our Locations on the Map: https://g.page/accountant-queens-cpa-firm-nyc?share https://g.page/accountant-nyc-cpa-firm-new-york https://goo.gl/maps/RspwfraQnwLQhfoW7 https://goo.gl/maps/5HyvFG6FphYZ5YJb7 Keywords: accountant nyc, cpa firms in nyc, manhattan cpa, cpa manhattan, best accountants nyc, manhattan cpa firm, manhattan accounting firms, best small business accountant, best cpa firm, best tax accountant, tax accountant manhattan, tax cpa manhattan, top nyc accounting firm, midtown manhattan cpa firm, accounting firms in manhattan, best cpa firms, , irs payment plan, tax preparation, retirement planning, tax lien, deferred tax asset, tax levy, tax audit, small business accountants, tax planning, federal tax lien, audited financial statements, payroll accounting, small business bookkeeping, cash flow management, tax resolution services, business consulting nyc, irs audit triggers, expatriate tax, international tax accountant, forensic accounting nyc, qualified domestic trust, business registration nyc, certified audit, tax representation, pension audits, financial statement review, international tax planning, international tax consultant, irs innocent spouse, accounting services nyc, strategic planning nyc, business accounting nyc, cpa self employed manhattan, high net worth retirement planning

HK Payroll Services, Inc. (HKP)

Payroll Service Company

- Tax Firms, Recruiting & HR

HKP is the workforce management affiliate of Honkamp Krueger & Co., P.C. (HK), a Top 100 CPA and business consulting firm in the U.S. From hire-to-retire, HKP can take a lot off yo…

View moreHKP is the workforce management affiliate of Honkamp Krueger & Co., P.C. (HK), a Top 100 CPA and business consulting firm in the U.S. From hire-to-retire, HKP can take a lot off your plate for managing your human capital including payroll, HR & benefits, time & attendance, tax credits, HR consulting, ACA/benefits consulting and retirement plans. Through this full plate of human capital management solutions, and professional services offered by both Honkamp Krueger and HK Financial Services, HKP provides a convenient and effective one-partner solution for your business.

- Workforce Management

- Payroll Processing

Books and Balances Inc

The Best of Outsourced Account Services for Small Businesses | Books and Balances Inc

- Middle Market ($$)

- Tax Firms

Put your money to productive use by studying the importance of financial services offered at Books And Balances INC. Let’s redefine economic growth.

- Book Keeping

- TAXATION

Why Your Business Needs US Tax Services?

Maintaining a proper financial and tax administration is a vital part of any business, small or large. Being compliant with all local, state, federal, and international tax compliance regulations is part of this administration process. Any failures or shortcomings in your tax compliance can have direct negative effects on your business performance. The US corporate tax system for businesses is one of the most complex tax systems in the world. Therefore, most companies have at least one financial expert employed, who is part of a company's core team, and who deals with all US tax aspects that come into play when running a business.

There are many reasons why your business may need some extra help of a US tax specialist. Besides helping clients to minimize overall tax liability, typical US tax services for businesses include:

- Prepare federal and state corporate income tax returns. At federal and state levels, different tax returns are required depending on the type of business you operate, in what state you operate it, and via what type of legal entity.

- Assist in collecting, reporting, and paying sales tax, which differs, per state and per type of business you operate.

- Assist with property tax on business property.

- Assist with excise taxes on use, consumption, or in relation to certain activities.

- Deal with potential self-employment taxes that may be due.

- Make sure all employment taxes are collected, reported, and paid in relation to your employees.

- Some states levy gross receipts taxes on businesses.

- Franchise taxes may be due depending on the state and the type of business you run.

- Provide international tax services in case your business also operates in foreign countries or deals with foreign companies, including transfer pricing services.

- Provide tax planning and tax structuring services for your business.

- Assist in tax audits from various tax authorities and provide representative services towards tax authorities.

Do You Need US Tax Services or Other Tax Services Located in the US for a Specific Expertise?

Our platform includes many US and non-US tax experts across a wide range of tax services. Find and hire tax advisors located in the US that have specialized in the following Service Lines:

Tax Generalist | Full Service Firm | Agricultural Levies & Refunds | Banking & Finance Taxation | Capital Markets & Structured Finance Taxation | Capital Tax | Tax Compliance & Reporting Services | Corporate Taxation | Country Tax Advisory | Customs & Excise Tax | Energy & Natural Resources Taxation | European Tax Law | Export Measures | Human Capital & Taxation | Import Duties & Exemptions | Indirect Tax | International Tax Services | M&A and Joint Ventures Taxation | Nonprofit & Exempt Organizations | Private Equity & Funds Taxation | Real Estate Taxation | Stamp Duty & Transfer Tax | State & Local Tax | Sustainability & Climate Change Tax | Tax Accounting Services | Tax Controversy & Dispute Resolution | Tax Efficient Supply Chain Management | Tax Incentives | Tax Performance Advisory | Tax Planning | Tax Risk Management & Tax Control Framework | Tax Rulings & APAs | Tax Valuation Services | Taxation & E-commerce | Transfer Pricing | US Tax Law Services | US Taxation in International Group Structures | VAT / GST / Sales Tax | Withholding Taxes | Other Tax Services

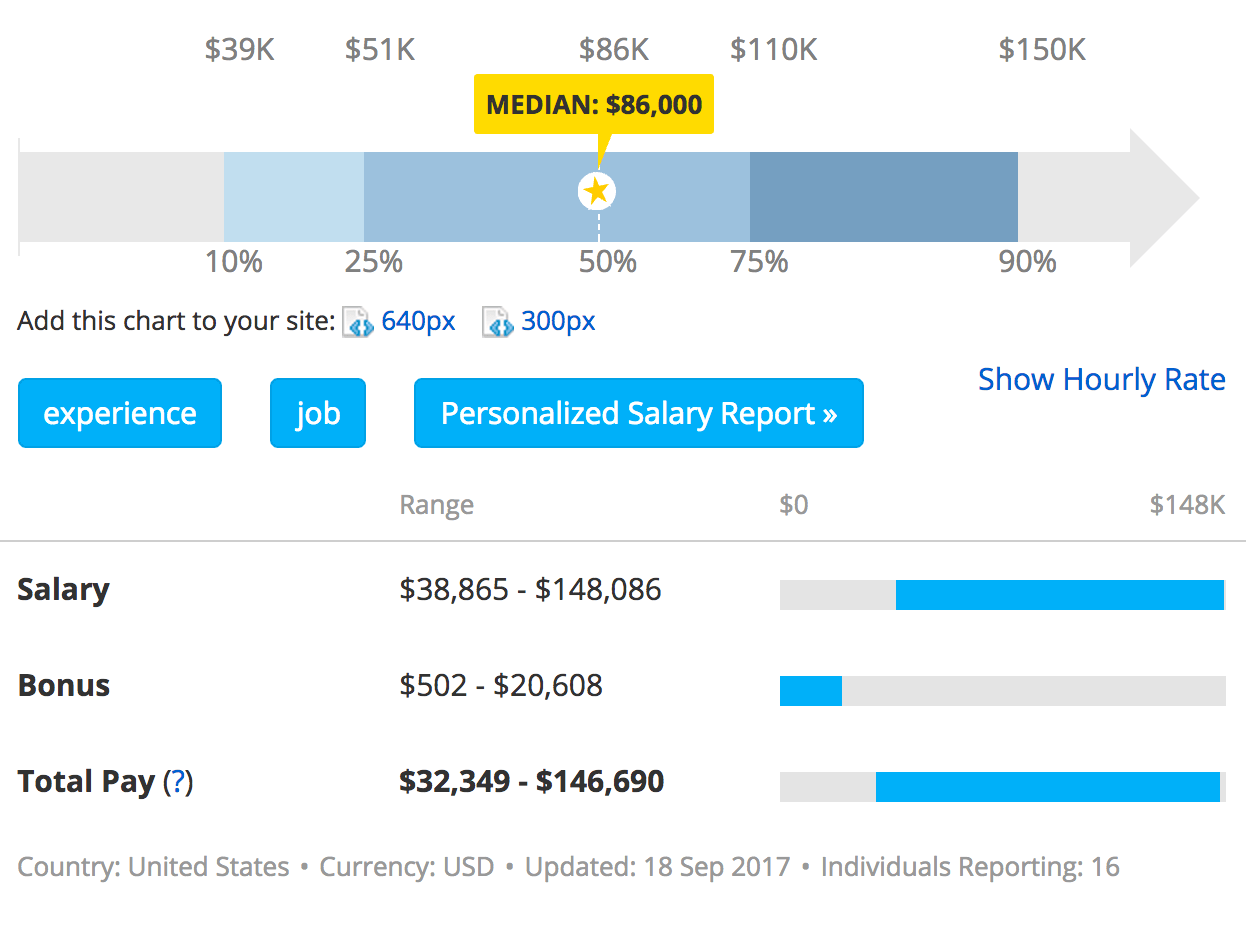

How Much Should You Pay for US Tax Services?

How much you should pay for US tax services depends amongst others on the reason why you need these types of services. Also, determining the average fees charged for US tax services is very hard to assess as it depends on so many factors and circumstances. Usually, tax services are charged by the hour, but fixed fees arrangements are becoming standard practice as well. Factors that affect the hourly rate charged, or the fixed fee arrangement, include the region where the service provider is located, the experience level, the type of clients or markets served and last but not least what kind of services provided which can be a more standardized routine kind of work or highly specialized work.

For example, low-value tax compliance work may be outsourced to a service provider somewhere in Asia for less than USD 10 per hour while the typical fees involved for providing tax advice on a major acquisition in the US can easily exceed USD 800 per hour.

Via our marketplace, you can search for the kind of tax services needed and fine-tune on key factors that affect pricing, like region, specialization, hourly rate, experience level and types of clients served. When you have found your ideal candidate for the job to be done, you can directly get in touch via email or phone and start working, without any charges or interference from our platform. Find out how it works.

As you can see on PayScale, the average salary of an experienced tax consultant based in the US amounts USD 86,000.

To get a general feeling about typical fees involved in the tax services industry you can also check out Robert Walters Annual Salary Survey. This survey gives very detailed insights about permanent, interim and contract placements across most part of the professional services industry, including the tax industry in the US, and differentiates on aspects like region, experience level, big firms or smaller ones and much more.

Not Sure Whether to Hire a Freelancer, Advisor or a Firm?

This is not a simple question to answer and depends on a lot of factors. First of all, it depends on your needs and the type of work to be done. Your available budget may play a role but should not be decisive because freelancers have a reputation to be relatively cheap while firms tend to be more expensive, but the same can apply vice versa. As for the quality of work, this fully depends on the freelancers and consultants/firms you hire. A freelancer may provide better quality work in half the time than that a firm could do. But, again the same could be vice versa. Furthermore, each of these service providers come with their own pro's and con's.

A freelance tax advisor in the US performs its work independently, selling work or services by the hour, day or job. Both parties involved have no intention to establish a long-term structural working relationship with each other. Often freelancer's worked as a consultant for US tax firms in their field of expertise, and at some point, in their career, they decided to do the same as they did but then via the freelancing route.

A US tax advisor is a person who is paid to provide professional or expert advice in a particular field or specialty, who is employed by a firm whose business is to provide these tax services via its consultants.

Professional services firms exist in many different industries. They include accounting firms, tax firms, law firms, marketing firms, consulting firms, and web design firms among others. They can be any firm that offers customized, knowledge-based services to clients. When clients hire US tax firms, they generally do so because of that company's credibility and reputation.

It is common knowledge that a business is only as good as its people. So with that in mind, a good starting point is to try to find the best person for the job first, and this can be a freelancer, a particular employed consultant, or a firm that has specialized in the field you are looking for.

Finally, the good news is that you can search for all these types of tax experts on our platform (freelancers, consultants, and firms) and compare them on the criteria that are relevant for you. Find out how it works or what other knowledge assets our platform has to offer like Knowledge Sharing, Knowledge Sources, and our Latest Sector News based on Curated Content to stay up to date with the latest news and developments.

Tax Services Industry in the US

Professional Service Firms are organizations that exist primarily of professionals who provide advice to business. They include all sorts of businesses, like tax services firms, accounting firms, law firms, management consulting firms, web development firms, and much more, most of which are listed on our platform.

Compared to most organizations, professional service firms, including US tax services firms, lack hierarchy, are decentralized and have diffuse authority structures. They are knowledge-intensive, and their primary currency is intellectual capital and expertise.

A services-dominated economy is characteristic of developed countries, while in less developed countries primary activities such as manufacturing, mining, and agriculture provide for most employment. According to Britannica, the services industry account for more than three-fifths of the global GDP and employs more than one-third of the global labor force. Therefore, Professional Service Firms now rival their Fortune 500 counterparts in nearly all measures of size and some of these firms, in all sectors, including the tax advisory industry, have become truly global players.

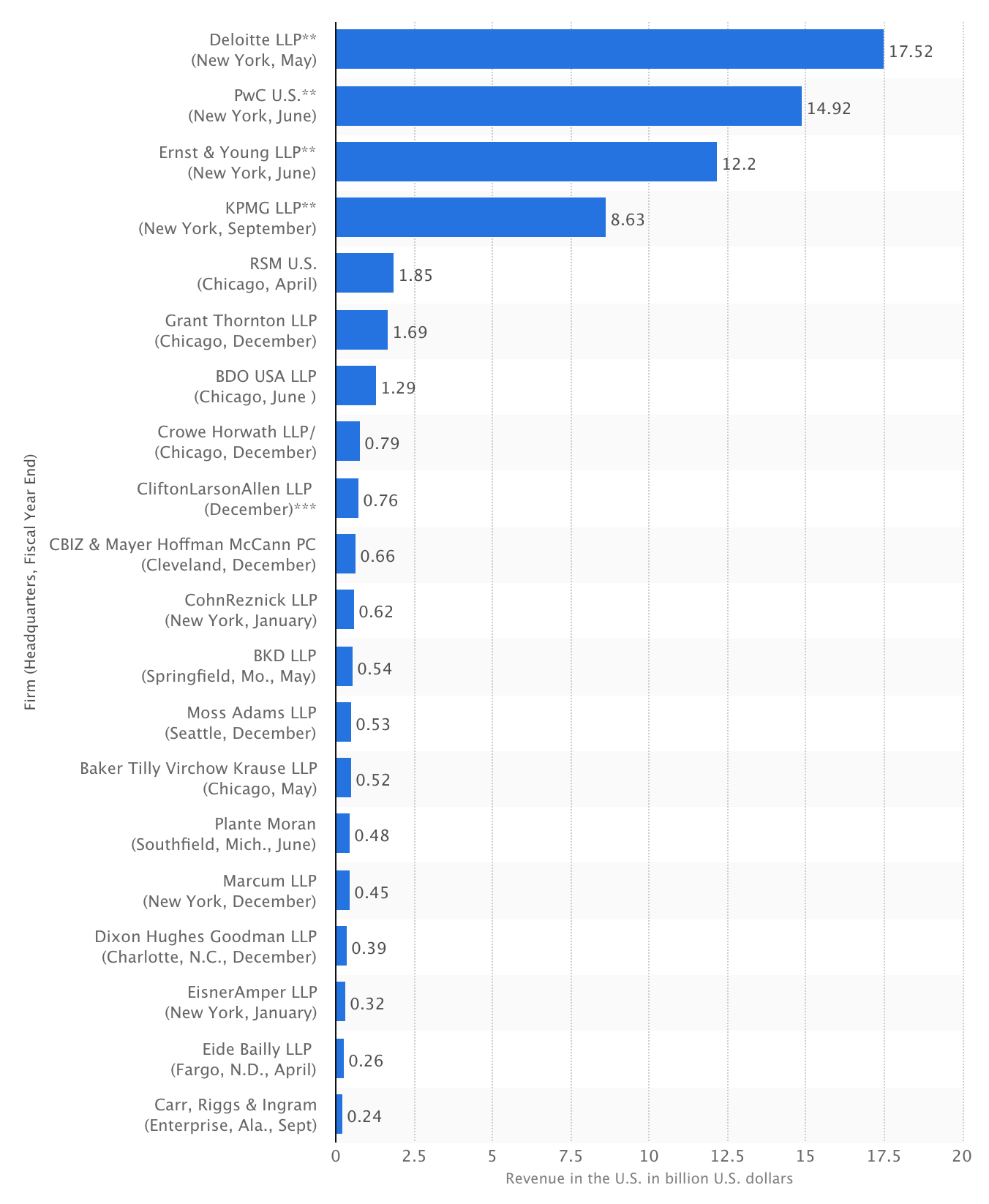

The professional services sector in the US is massive and is the largest in the world. The world's leading professional services companies are located in the US serving their large and dynamic corporate sector. The sector in the US exists of more than 888,000 firms, employing about 9 million Americans and generates more than USD 1,6 trillion revenues according to a report from the International Trade Organization about the Professional Services Industry in the US. The Tax Services Industry in the US is an important and profitable industry that is part of the Professional Services Industry in the US.

As can be seen from Statista, in the US, the tax services industry is dominated by the accounting firms, and in more particular, the Big Four.

Professionals that provide US tax services to businesses typically work in the following sectors:

- Accounting Firms - The accounting sector in the US, generates more than USD 156 billion in revenues, exists of nearly 132,000 firms and employs more than 1.4 million accounting professionals. A significant portion of tax advisors in the US work for large or smaller accounting firms. In general, tax services are one of the primary service products of accounting companies. The tax services provided by these firms range from tax advisory services, tax compliance services to highly specialized tax services like tax valuation services or tax incentive services.

- Law Firms - The legal services sector in the US, generates more than USD 278 billion in revenues, exists of nearly 187,000 firms and employs around 1.2 million legal professionals. A very substantial portion of tax advisors works for law firms where tax advisory can also be one of the firm's core activities. The tax services provided by tax lawyers is to a large extent comparable to the tax services provided by accounting firms, but law firms tend to provide less tax compliance related services and these firms and their tax lawyers focus more on the legal technicalities from a tax law perspective.

- 100% Tax Advisory Firms - Some firms have fully specialized in providing tax advisory services to their clients. A large portion of these type of firms provides a broad range of tax advisory services comparable to the tax services provided by the accounting and law firms. On the other hand, some firms have fully specialized in one type of tax services like transfer pricing services, tax compliance services, indirect tax services or real estate taxation services.

- Freelance Tax Advisor - Some tax experts perform their jobs as a freelance tax specialist. These freelancers are typically hired as an in-house tax specialist by companies for a period to provide all sorts of tax services. These freelance tax advisors may partly take over the work that is usually done by the tax advisors of the accounting or law firms. However, it is also widespread that these freelance tax experts operate as the link between the business that hired them and the tax advisory firm enabling the tax advisory firm to focus more on highly specialized tax advisory services at a more senior level.

- In-house Tax Advisor - Tax experts also work for private or public companies performing most or part of the work that was traditionally done by external tax advisors. A company may have only one tax director, or it may have a large tax staff made up of the tax director, a tax manager and lesser experienced tax specialists. Generally, the larger the company, the bigger its tax team.

As a result of globalization, business developments, continuous changes in tax regulations and many other factors, the tax industry is in a constant state of flux. Tax advisory firms now compete with non-tax advisory service providers and some tax services are offshored to foreign countries.

The way the professional services industry works, including the tax industry, has changed dramatically during the past few decades. Technology developments enabled working with massive amounts of data, work remotely, and deal with clients and colleagues at any place at any time. These technology changes are expected to continue at a fast pace in the future, and some experts predict that the traditional professional services industry will likely be radically different in ten years. We have further outlined the main causes and the main sectors impacted by ongoing disruption in our analysis: The Future of the Professional Services Industry.

Independents in the Tax Services Industry

There is no strict definition of what an Independent is in the professional services industry, including the tax services industry. In general, Independents are independent firms that are owner operated, they tend to work in their own country only and the bigger the standalone business is, the more different types of services provided. Boutique firm or agency is also a commonly used name for these type of entrepreneurial businesses. They tend to provide highly specialized niche services, but they may very well also directly compete with the major international firms in their industry. Strictly speaking, freelancers also qualify as Independents.

It happens very often that experienced senior professionals break away from the major players that hired them to set up their own independent firm and start a more entrepreneurial journey. Besides autonomy and more control, the ability to better define personal purpose is a typical driver to work for Independents or to start one yourself.

Due to their size, market power, and marketing budgets, larger international firms are usually easily found in the market. Small independent type of businesses do not have this luxury, and as such, they need to be more creative to find new work on a continuous basis. Using platforms like Consultants 500 is a perfect way to create extra opportunities because our primary focus and purpose are to help clients find independents in the professional services industry, including independents in the tax services industry.

Looking for local US Tax Services?

As stated earlier, the professional services sector in the US is massive and is the largest in the world. The sector in the US exists of more than 888,000 firms, employing about 9 million Americans and generates more than USD 1,6 trillion revenues. The tax services industry is a significant sector of the professional services industry in the US. As such, it is not hard to imagine that there are literally millions of tax advisory firms and professionals who provide tax services to individuals, small businesses, or the worlds leading corporations, each of them having their own specialization.

These tax experts can either work as a freelancer, or they can be seasoned professionals who work for small or large professional services firms that provide US tax services.

As said earlier, via our platform you can search for local ax services in any location in the US, fine-tune on criteria like specialization, hourly rate, and what type of clients they typically serve. And if you are looking for a particular tax expertise you can just fine-tune your search criteria.

Discover the Latest News, Developments, Resources, and Community Knowledge in Tax

Knowledge is a fundamental cornerstone of our society. Without the ability of knowledge being gathered, shared and passed on to the next generation our world would look entirely different today, and we would be re-inventing the wheel again and again. Throughout human history, the capacity to gather and analyze information has existed and has been a key driver for further evolvement.

As a result of rapid technological developments in the last decades, and much more to come, knowledge and information have been put in another perspective. There has been a vast increase in data creation, and the way knowledge is obtained and shared in society has totally changed.

Still, the primary currency of a tax expert and all other professionals in the Professional Services Industry is knowledge. Staying up to date with the latest tax developments is also key for businesses in need for a tax firm. As we all know, the internet is an invaluable resource for knowledge these days. The only problem is that there are tons of sources for learning and staying up to date with the latest developments.

Via these knowledge sources on our platform you can learn more and stay up to date with the most recent tax developments:

- Knowledge Sharing - Via our Tax Community Forum all visitors can raise and answer questions about any tax subject you can think of. Here you can sort and follow tax posts to stay informed with the latest updates. Via up-voting and down-voting, the most relevant answers are highlighted. All our Business Services categories have their own Community Forum.

- Knowledge Sources - As said earlier, the internet is loaded with valuable information, the only problem is how to find it. Via Tax Knowledge Sources, the best tax sources on the web are organized in a structured way. Think of best blogs, the biggest firms, industry overviews, salary surveys, infographics, handy tools and much more, all related to t Via the ability to make comments and online surveys on each subject, our users and visitors can share their best sources. Because we update all Knowledge Sources categories on a regular basis with the best sources shared by our users and visitors, the knowledge-power continually improves and keeps up to date with the latest developments.

- Latest News & Developments - Via our Tax Briefing Room you can stay up to date with the latest and most shared content of the best tax resources on the internet. This Briefing Room follows the top tax resources on the web, which includes the best sources as suggested by our users and visitors. Only the most shared content is shown, and you can filter all the content for the last 24 hours, 3 days, 1 week, 1 month, 3 months, etc. so you can easily find and stay up to date with the latest tax All our Business Services categories have their own Briefing Room so you can stay up to date on any subject you want without seeing publications that are not relevant to you.

On our Blog, you can read about a wide area of subjects that are relevant for the Business Services covered by our platform, like Checklists, Best of Lists and many more topics. In our article The Future of the Professional Services Industry you can read more about the current age of disruption, the role of technology, the main sectors impacted and the main causes and disruptors.

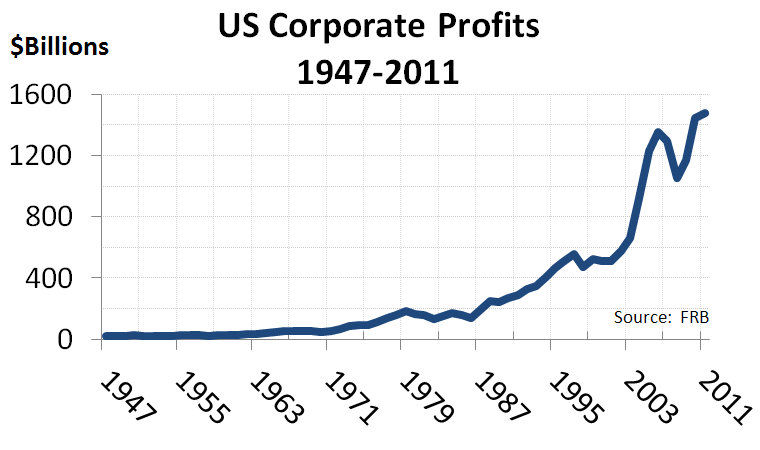

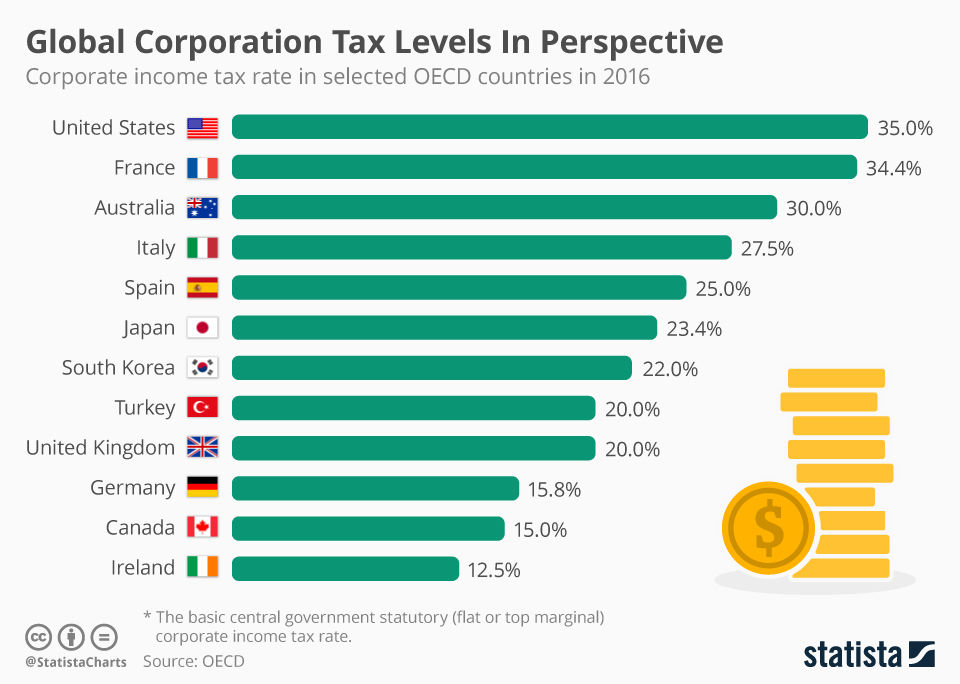

Corporate Taxation in the US and the rest of the World

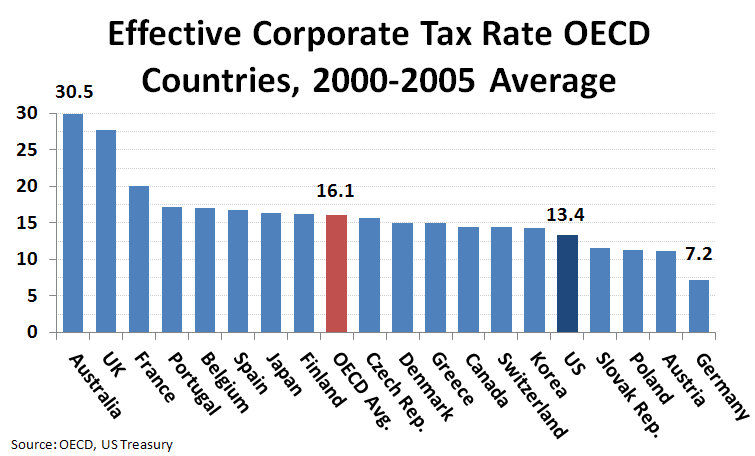

The US has one of the highest corporate income tax rates in the world.

However, the US has one of the lowest effective corporate income tax rates compared to other OECD countries.

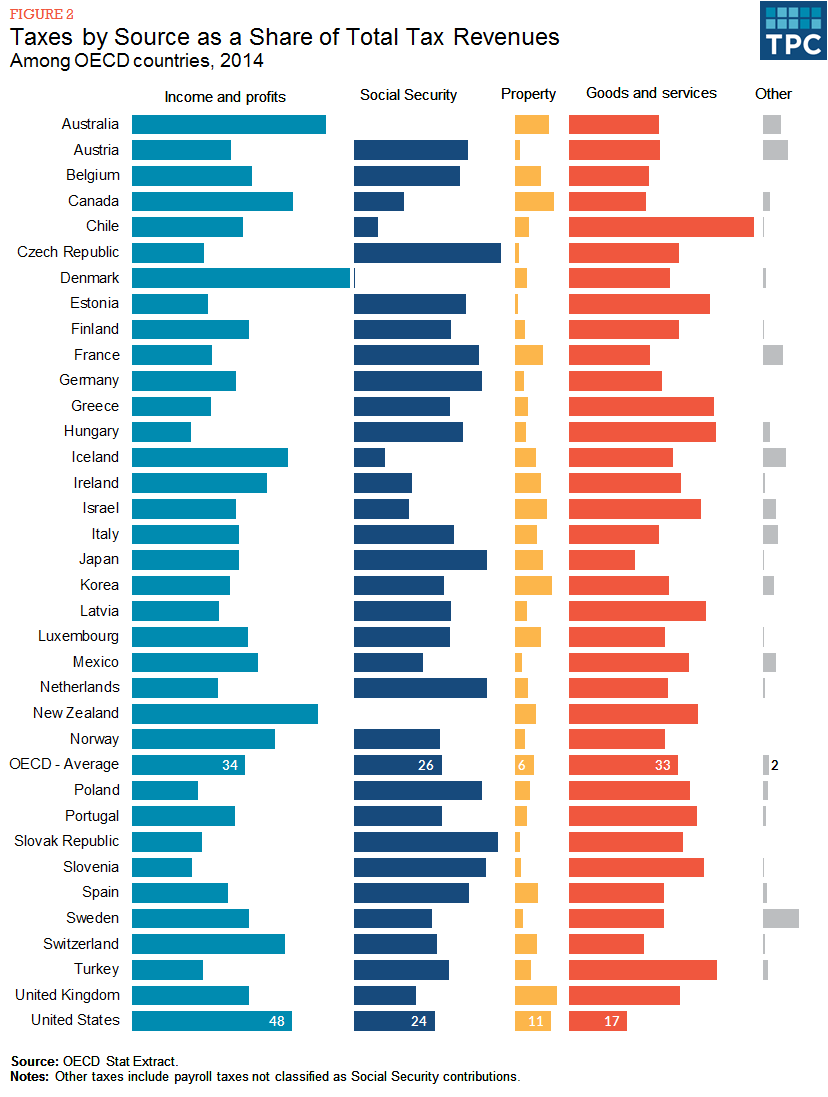

Compared to other OECD countries, the US gets most of its tax revenues from income and profit taxation, while other nations tend to tax goods and services significantly more (VAT / Sales Tax / GST).

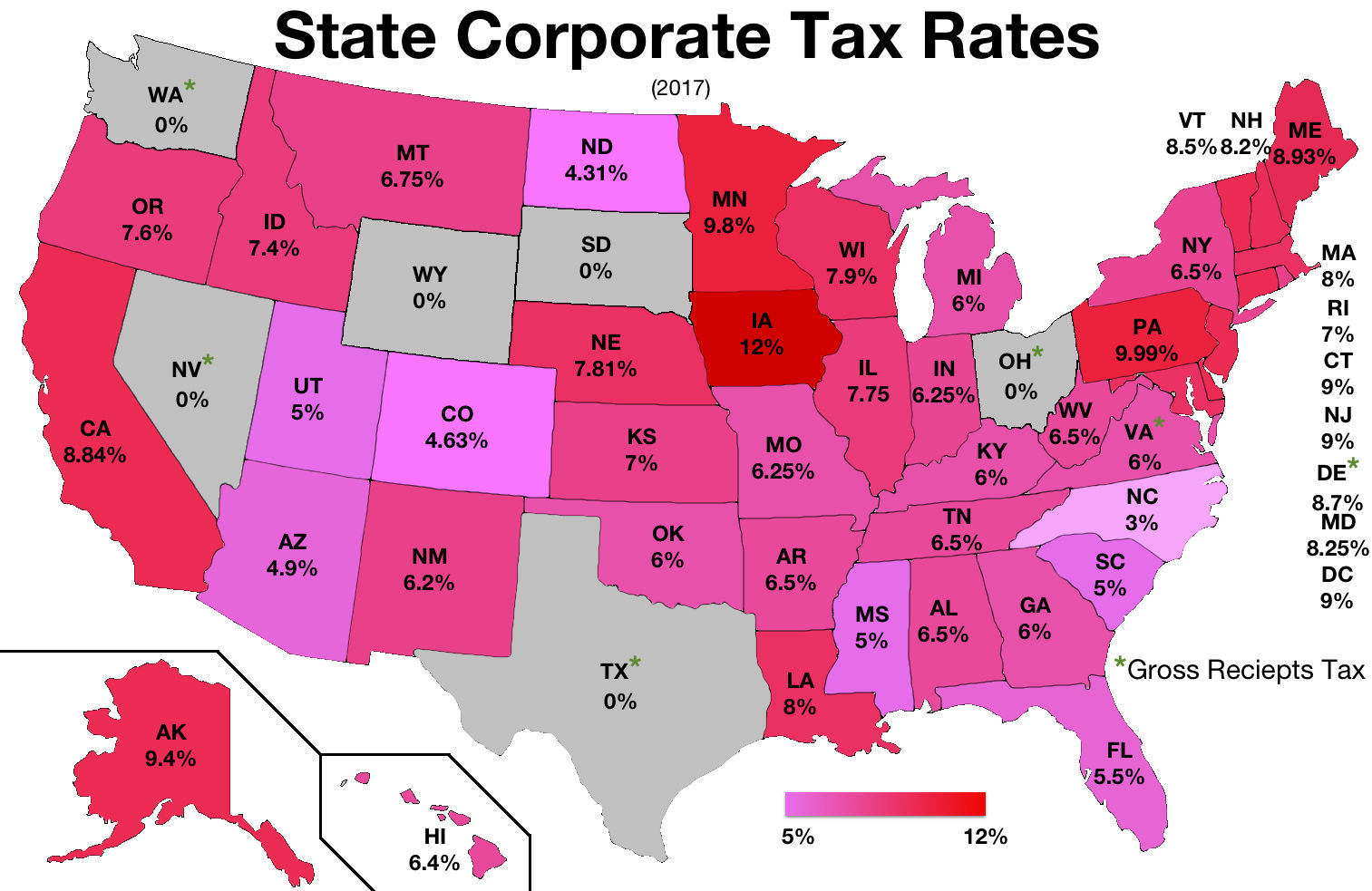

As you can see, there are significant differences between the applicable state corporate tax rates in the US.

Other Relevant Resources

- Tax Global: Tax Services | Freelance Tax Consultant | Tax Consultant | Tax Firm

- Tax Country: US Tax Services

- Tax City:

- Accounting Global: Accounting Services